How To Qualify For Solar Tax Credit . This incentive is also known. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. learn how to claim the 30% residential clean energy credit for your solar system installation from 2022 to 2032. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. In august 2022, congress passed an extension of the itc,. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar.

from ilsr.org

learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. This incentive is also known. to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. In august 2022, congress passed an extension of the itc,. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. learn how to claim the 30% residential clean energy credit for your solar system installation from 2022 to 2032.

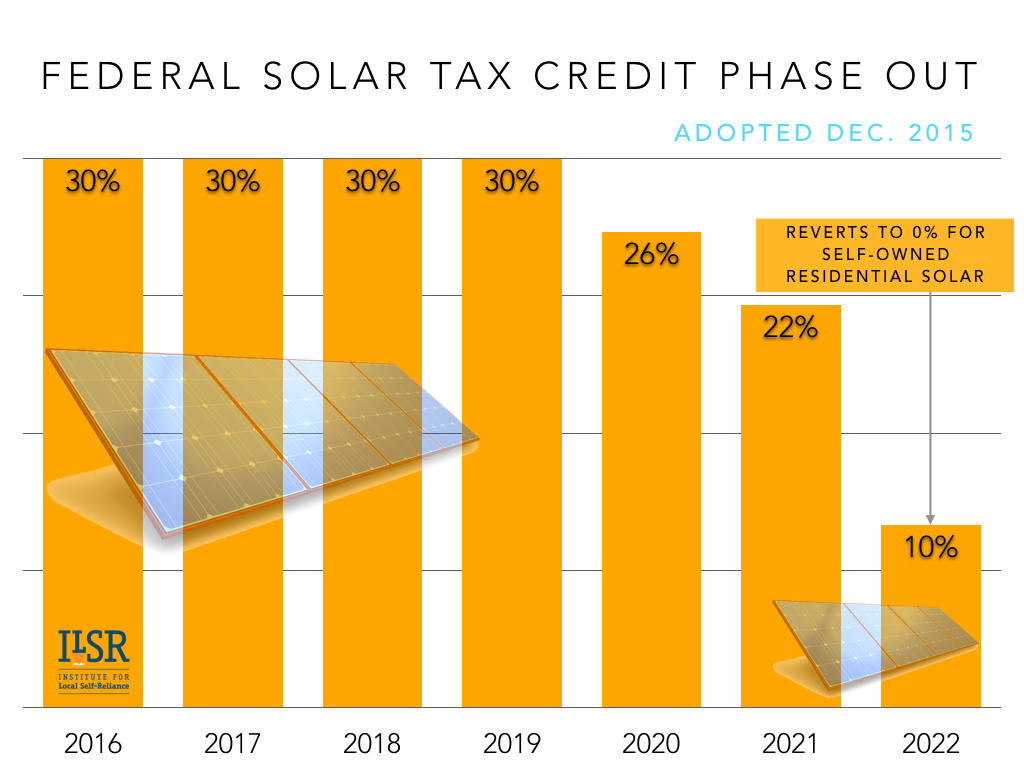

Congress Gets Renewable Tax Credit Extension Right Institute for

How To Qualify For Solar Tax Credit to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. learn how to claim the 30% residential clean energy credit for your solar system installation from 2022 to 2032. to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. In august 2022, congress passed an extension of the itc,. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. This incentive is also known.

From www.solarfinancefund.org

Activate Your Solar Tax Credits! IRS Opens the Energy Credit Online Tools How To Qualify For Solar Tax Credit to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. In 2024, the itc currently allows both homeowners and. How To Qualify For Solar Tax Credit.

From ilsr.org

Congress Gets Renewable Tax Credit Extension Right Institute for How To Qualify For Solar Tax Credit solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation.. How To Qualify For Solar Tax Credit.

From solar112.com

Solar Tax Credit A Guide for Residential Solar Energy Incentives How To Qualify For Solar Tax Credit In august 2022, congress passed an extension of the itc,. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim a 30% tax credit for installing solar panels or other clean energy property. How To Qualify For Solar Tax Credit.

From news.energysage.com

Why the Solar Tax Credit Extension is a Big Deal in 2020 EnergySage How To Qualify For Solar Tax Credit learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032.. How To Qualify For Solar Tax Credit.

From greenridgesolar.com

A Guide to the 30 Solar Tax Credit Green Ridge Solar How To Qualify For Solar Tax Credit In august 2022, congress passed an extension of the itc,. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. learn how to claim the. How To Qualify For Solar Tax Credit.

From ieconstruction.com

A Complete Guide To The Federal Solar Tax Credit How To Qualify For Solar Tax Credit In august 2022, congress passed an extension of the itc,. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. learn how to claim the 30% residential clean energy credit. How To Qualify For Solar Tax Credit.

From www.pinterest.com

Solar tax credit Top tips for taking this credit on your RV in 2023 How To Qualify For Solar Tax Credit learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. This incentive is also known. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. solar pv systems installed in 2020 and 2021 are eligible. How To Qualify For Solar Tax Credit.

From mechtechtutorials.com

10 Ways To Maximize Solar Energy Tax Credits In The US How To Qualify How To Qualify For Solar Tax Credit This incentive is also known. learn how to claim the 30% residential clean energy credit for your solar system installation from 2022 to 2032. In august 2022, congress passed an extension of the itc,. to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable. How To Qualify For Solar Tax Credit.

From staraltsolar.com

How To Claim The Solar Tax Credit StartAlt Solar Solar How To Qualify For Solar Tax Credit learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar.. How To Qualify For Solar Tax Credit.

From cerytoqv.blob.core.windows.net

Tax Credits For Solar Panels Illinois at Ronald Boone blog How To Qualify For Solar Tax Credit learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. This incentive is also known. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar.. How To Qualify For Solar Tax Credit.

From www.solarsam.com

How to Claim the Federal Solar Investment Tax Credit Solar Sam How To Qualify For Solar Tax Credit to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. This incentive is also known. In 2024, the itc currently allows. How To Qualify For Solar Tax Credit.

From www.energy.gov

Federal Solar Tax Credits for Businesses Department of Energy How To Qualify For Solar Tax Credit learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. solar pv systems installed in 2020 and 2021 are eligible. How To Qualify For Solar Tax Credit.

From amsunsolar.com

How to Claim Your Solar Tax Credit A.M. Sun Solar & Roofing How To Qualify For Solar Tax Credit This incentive is also known. In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032.. How To Qualify For Solar Tax Credit.

From cerytoqv.blob.core.windows.net

Tax Credits For Solar Panels Illinois at Ronald Boone blog How To Qualify For Solar Tax Credit to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. In august 2022, congress passed an extension of the itc,. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until. How To Qualify For Solar Tax Credit.

From garagefixtienmaalys.z22.web.core.windows.net

Tax Credit For Plug In Hybrid 2024 How To Qualify For Solar Tax Credit In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. In august 2022, congress passed an extension of the itc,. This incentive is also known. learn how to claim a 30% tax. How To Qualify For Solar Tax Credit.

From www.alchemy-solar.com

Federal Investment Solar Tax Credit (Guide) Learn how to claim the How To Qualify For Solar Tax Credit In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. This incentive is also known. learn how to claim a 30% tax credit for installing solar panels or other clean energy property in your home until 2032. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit.. How To Qualify For Solar Tax Credit.

From amsunsolar.com

Benefits of the Solar Investment Tax Credit for the Everyday Consumer How To Qualify For Solar Tax Credit In 2024, the itc currently allows both homeowners and businesses to claim 30% of their solar. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. learn how to claim tax credits for energy improvements to your home, such as solar, wind, or geothermal power generation. learn how to claim the 30%. How To Qualify For Solar Tax Credit.

From www.youtube.com

The Solar Energy Tax Credit A How To Video 1040 Attachment 5695 How To Qualify For Solar Tax Credit solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. In august 2022, congress passed an extension of the itc,. to claim the solar tax credit, you'll need first to determine if you're eligible, then complete irs form 5695 and finally add your renewable energy tax credit. In 2024, the itc currently allows. How To Qualify For Solar Tax Credit.